Booking Process Step: Insurance

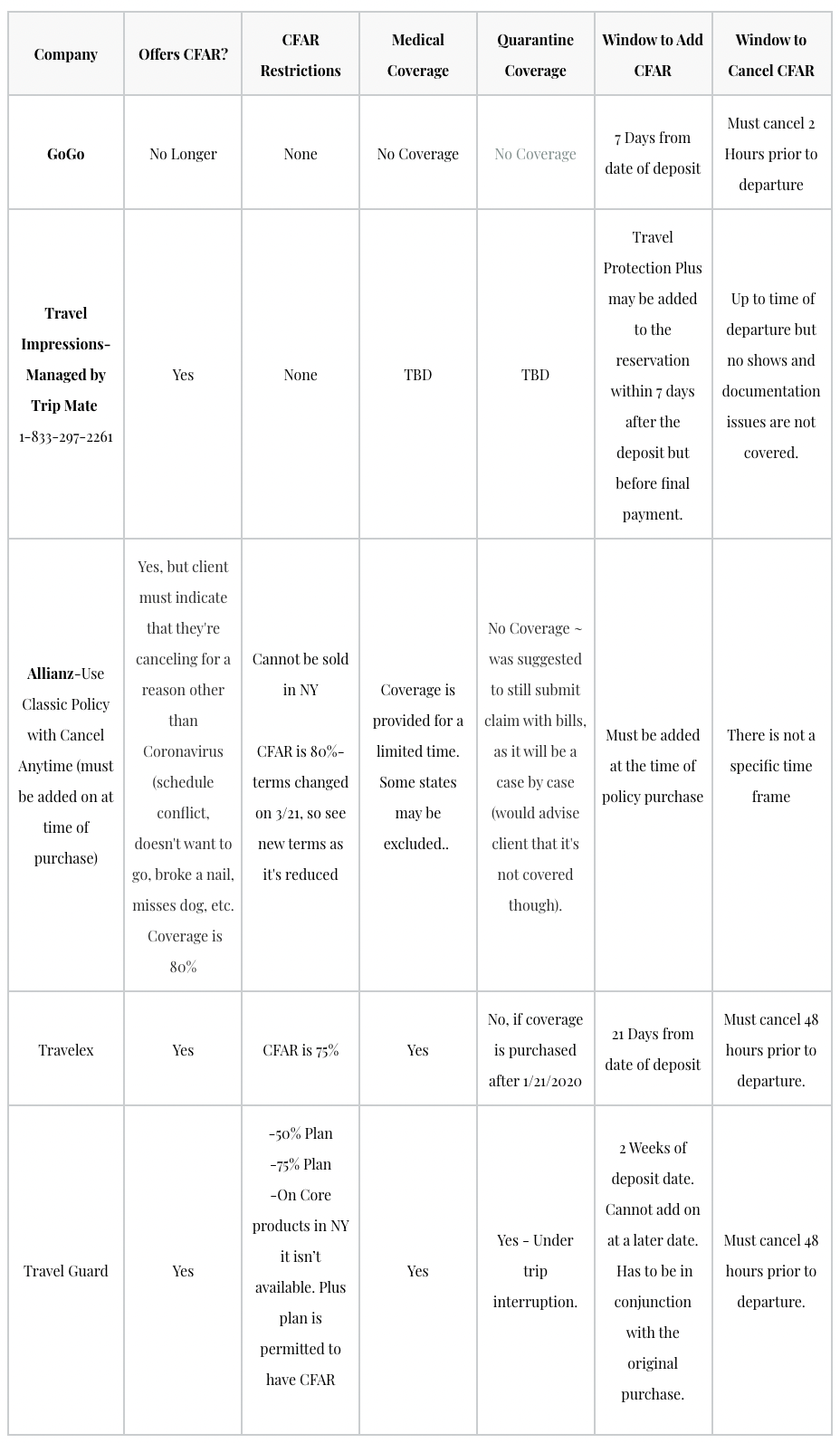

Tour Op-Cancel For Any Reason (CFAR)

Cancel For Any Reason (CFAR) allows clients to cancel for any reason right up to departure. Generally it has to be added at the time of booking or very soon after (varies by supplier).

A few things to note about CFAR insurance:

- When adding insurance to a booking, CFAR (Cancel for any Reason) must be added at the time of booking for FIT bookings (groups can have different policies).

- Insurance is non-refundable after a certain period of time (varies by product, so check with the supplier). Generally it can be cancelled within about 7-10 days, but after that no refunds (except in certain states).

- If a client cancels the trip, upon payout of their claim, request commission protection form at the time of cancellation to receive your commission. Each supplier has a different process for this.

- CFAR makes it very easy for a client to cancel their trip, which can be good and bad.

- CFAR typically provides the best pre-departure coverage if a client anticpates a potential need to cancel, such as pregnancy, babysitter issues, health concerns, etc. It doesn't provide a lot of coverage while a traveler is on the vacation.

Tour Op CFAR Options:

TI Insurance Info

GoGo Insurance Info

Third Party Insurance

Insurance laws are VERY specific and you never want to "guess." Always pick up the phone and call the insurance company for more details. The information below is listed as a guideline and can vary by policy. Call the insurance company for specific details pertaining to the policy you are using. Please ensure you take any applicable training courses provided by the insurance company prior to booking.A few things to note about traditional insurance:

- Many traditional policies don't cover weather events (hurricanes, blizzards, epidemics, etc), but they do cover the effects of these like airport closures & delays.

- Often times children are free under the age of 18 with a traditional policy, which can bring the cost of the policy down quite a bit & typically less than a CFAR policy from a TO.

- When requesting a quote for a traditional policy, use ages at the time of BOOKING not TRAVEL.

- Traditional policies don't cover the "fear of an event," such as Zika, Coronavirus, hurricane, etc. Your clients will not be able to cancel for these reasons.

- Check with your insurance company to see if they offer in-travel concierge services for your clients if they have an emergency. Many do and this can be very helpful when selecting hospitals & receiving treatment.

- Just because a client gets pregnant, that's not a valid reason for cancellation. The doctor would have to provide a note indicating that she is not able to travel due to the pregnancy.

- Wedding Expenses-Any pre-paid nonrefundable cost can be insured under the Allianz Classic policy. For the Classic policy one can insure up to 100k per person and Classic with CAT caps out at 10K per person. It is not limited just to travel arrangements and as long as it is pre-paid nonrefundable one can include on the policy.

Third Party Insurance:

Allianz Insurance Info

Travel Guard Insurance Info

Client not purchasing insurance?

Send Insurance Waiver Form/VCRM Invoice Approval form for client signature (if this is customary with your agency) if your client chooses not to purchase insurance. Set reminder 3 days for it, Upload into VCRM once received. Travel documents should not be sent to the client until this is received. Refer to your agency owner for customized agency specific form or alternate method of securing client opt in or decline for legal documentation purposes.

Allianz

Training Resources Webpage

Allianz Specialist Training

Quoting/Purchasing Process:

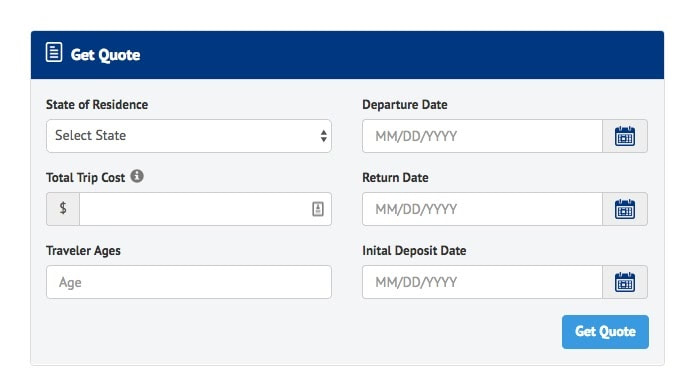

- Step 1 - Go to https://www.agentmaxonline.com/ and login to your account.

- Step 2 - Enter your clients travel information. Helpful tip-Enter the clients date of birth instead of their age. Insurance uses the age at the time of purchase, not the time of travel, which can benefit the client.

- Step 3 - You will then click “Get Quote.” Once you click this button you will receive numerous product offerings. To make things easier, we would suggest narrowing it down to two: Classic and Classic with Any Time.

- Classic Insurance - The Classic Plan can prepare your clients for the unexpected with generous levels of protection for domestic and international travel. It's the ideal travel companion with features like trip cancellation protection, emergency medical benefits, 24-hour emergency assistance, and available benefit enhancements that can tailor the plan to fit specific needs. This plan also includes smart benefits that can proactively pay your clients and simplify the claims process with no receipts required. Plus, kids 17 and under are covered for free when traveling with a parent or grandparent.

- Classic Insurance w/Cancel Any Time - The Classic with Cancel Anytime Plan gives your clients the extra flexibility of knowing they can cancel their trip for almost any unforeseen reason that the Classic plan does not already cover at 100% and receive 80% of their non-refundable trip cost back. It includes benefits like trip cancellation protection, primary emergency medical benefits, 24-hour travel assistance, and more. This plan also has smart benefits that can proactively pay your clients and simplify the claims process with no receipts required. This is Allianz’s version of CFAR. If using for Covid, don't list your reason for cancellation as Covid.

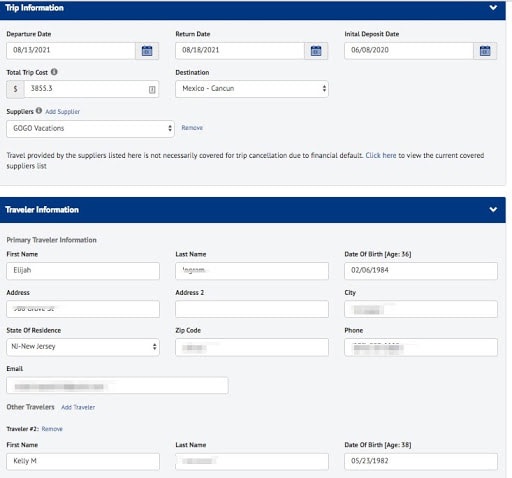

- Step 4 - Once you have chosen the plan, you will then be directed to the client information page. Make sure to enter all the information below and hit the “Save Button.”

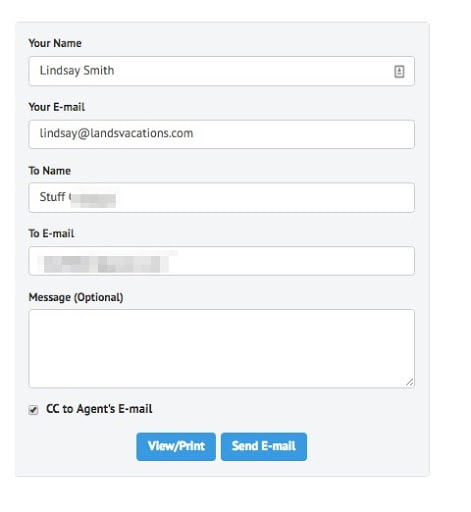

- Step 5 - Once you have successfully saved the quote, please hit the “Email Quote Button.” By choosing this option you will email the coverage of the insurance to the client, so they can see exactly what is and what is not covered. It is recommended to save the quote for quicker processing.

- Tip: When sending this email you can personalize the email or send to multiple email addresses using the box below.

- Step 6 - When the client is ready to purchase, you can enter their credit card information on the Trip Information page below. In the quote email there is a "click here" button that your clients can purchase their insurance directly through the quote. You still receive commission on this purchase, but you won't receive a confirmation from Allianz; therefore, it won't be on your client invoice. It is typically discovered when the commission is paid out.

- IMPORTANT: If you are purchasing Classic Policy WITH Cancel Any Time that has to be purchased on the same day the trip is deposited. If you're purchasing Classic, it can be done up until the day before travel. Pre-existing condition coverage is only included if purchased within 14 days of the initial deposit.

Sales Emails - Allianz automatically sends sales emails (if your agency has opted in to 2nd Chance Emails) to each person that you have saved a quote prompting guests to purchase insurance. If the guests do purchase insurance after 14 days of making the deposit they are not eligible to have pre-existing medical conditions covered. The email reminders are sent at the following intervals:

- 7 Days after the initial quote

- 30 Days prior to departure

- 10 Days prior to departure

- 5 Days prior to departure

Allianz FAQs

Tips & Tricks:

- Allianz provides bankruptcy protection for many travel suppliers. Click here for a complete list.

- If you have a family split in two reservations you can place all on one insurance policy assuming they live in the same state. Please see rules for New York/Washington/Texas residents below.

- Insurance is non-refundable after a certain period of time (varies by product, so check with the supplier). Generally it can be cancelled within about 7-10 days, but after that no refunds (except in certain states). With Allianz, the states that can be cancelled at any time are GA, FL, KS, NY, SC and MT.

- When adding insurance to a booking, with independent insurance, many policies must be added within 14 days of deposit in order to receive full coverage. Generally it covers pre-existing conditions if added within the 1st 14 days of the initial deposit. If added after, then pre-existing coverage isn't included, but the policy remains the same cost.

- Ensure the insurance is processed immediately upon request & mailed directly to the client via USPS,

- Clients residing in different states can't be on the same insurance policy due to a difference in state laws.

- If the client books their own air, the cost of the air can be added to a traditional policy even after booking. When doing this ensure that the travel dates match the policy. These changes can be made on Agent Max by modifying the policy. Tours, transfers, etc., can be added to any traditional policy regardless of where they're booked.

- Test positive for Covid before leaving the US? Yes, covered, so you can cancel your trip as long as you cancel within 72 hours of the diagnosis.

- Trip is in May, but they test positive today—(unknown illness that occurs after the date of the policy)-you can cancel even if the trip is a year after, but must cancel within 72 hours

- Is the test to re-enter the US covered by travel insurance? No

- If one passenger in a family that bought a plan tests positive in Jan 2021 and they are traveling June 2021, they can all be refunded as well correct? Yes, they could all cancel

- What if they have insurance with the resort is free, but clients bought Allianz. Does the resort cover first few days then secondary insurance kick in? You wouldn’t have to since Allianz can be primary, but it may be easier to use the resort’s insurance. If a person has to go to the hospital, then use Allianz for medical coverage.

- Peace of mind-can help determine hospitals, look at Travel Smart app. They can wire funds to the hospital within a provider network. Can assist the client coming home if they need oxygen, two seats, etc.

- Does the medical and stay in destination come out of pocket up front then file claim on return? If it doesn’t require hospitalization, then yes. File a claim after travel is completed (should apply within 180 days). If you have to stay in the hospital, funds can be wired from Allianz.

- Travel Delay-weather, FAA mandate, strike, missed connection

- Trip Interruption-Interrupt your trip bc of unknown illness, death, court appearance.—unused portion of trip and cost to get home

- What states require you to be licensed to get paid commission? New York and Hawaii-in order for us to get commission, we have to be licensed in those states. NY requires individual and agency licensing.

- Classic CAT

-must be purchased within 14 days of original date of deposit

-Max benefit $10,000 for CAT (only policy that has this

New York/Washington/Texas Residents:

- Guests with different last names must have separate insurance policies.

- Guests over the age of 25 and living at a different permanent address must have a separate policy

Allianz Return to Work Coverage

If the client is required to work, they just need a letter from their employer stating so and they get 100% of the cost of their trip back less the cost of insurance?

- Yes, must be signed by employer and notarized as well. Also, keep in mind, The required to work add-on must be booked within 14 days of payment or deposit.

For clients who are independent contractors or self-employed, they would just need to write a letter and have it notarized to get 100% of the trip back less the cost of the insurance?

- Yes, same as above.

If a client does enact the Return to Work Feature, we are still eligible for commission protection?

- Yes as long as the claim is a payable claim, not on a denied claim, if their reason for canceling is not valid or have not provided Allianz enough info.

Filing a Claim

- If a client needs to file a claim, it must be done after travel. Save all forms of documentation, such as, cancelled/delayed flight notifications, hotel receipts, and meal receipts.

- You can add service/cancellation/change fees to the booking and the client can claim these as long as they are included in the amount.

- Clients should file their own claims on the Allianz website or over the phone. The TA should not do this for the client.

- Once they advise you that they are filing a claim, provide them a copy of their invoice. If using an agency invoice vs a supplier invoice, please add a field and clearly note any penalties assessed.

- If a client cancels the trip, upon payout of their claim, request commission protection form at the time of cancellation to receive your commission. The supplier should send you an email verifying that no commission was paid out to you. Once the clients' claim is approved then you should submit the form above. It typically takes about two weeks and you will receive full commission for the booking.

Coverage (as of 3/8/2020)